Misc. Revenues....2018 totals

This will be the first in a series of accounting reports about year end financial reports.

The readers of this blog will have far more detailed reports of the financial actions of the association than the brief report that will be available in July at the Annual Meeting. You will see that our association is being managed by a group of amateur individuals with no accountability. The number one duty of the Board is the management of member funds. This is called a fiduciary responsibility.

It is clear to me that the Board has time and again failed. As you review these reports, keep in mind that there will be adjustments made, due to the audit and expenses accrued in December, that are not billed until Jan. of this year. For example, the total legal fees of 112,781.99 could go even higher.

I am not by any stretch, an accountant, but was a business manager for 15 years and prepared many budgets with 15 employees and accountable to a board of directors. In other words, I know a little something about budgets and how to use them as a tool to success and accountability. Any business person will agree that this association falls short of the fundamental business practices required and deserved by the members.

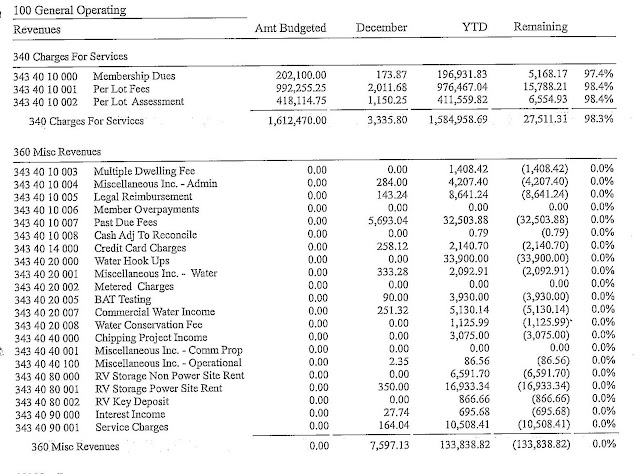

The two items for discussion in this posting are briefly the member payments and the Misc. Income report.

340 Charges For Services:

You will note in the report below that 27,511.31 remains to be collected. 98.3% of the amount due, has been paid. These are good numbers and are consistent with year after year payments. The prepared budget is based on full payment. Common sense would say that you should reduce budget spending by that amount to stay in the black.

360 Misc. Revenues:

Until the last few years, it was the practice to budget around 60,000.00 as Misc. income. It is note able that the budget projects no amount. The 133,838.82 ends up being a slush fund that can be used anyway the Board wants. It can be used to cover the over budget spending like legal fees.

Water hook Ups should be a credit to the water department. Chipping income should be credited against the chipping cost. (which by the way, the cost far exceeded what was collected). RV storage should be credited against the cost of that operation. (Collection exceeded expense)

The Misc. Income represents nearly 10% of money collected for the budget operations but has 0%

accountability. We need to hire professional people to manage our financial affairs.

Click once or twice on the report below for a larger read.

2 comments:

Thank you very much George!

I agree with your recommendation.

The 2018 budget provided for a large payment to the Reserve Acct. from which money was borrowed for the CTP. Was any payment made to the Reserves ? I haven't seen that indicated anywhere. There was money budgeted for the Enclosure building for the CTP. That money was obviously spent on other things.

With the fines and overspending, it seems that creative accounting has painted a much rosier picture than really exists. About $45,000 spent on asbestos abatement, and about $65,000 over budget on legal spending - big numbers that add up quickly - money spent that was not budgeted, and shouldn't have been necessary to spend.

Post a Comment